A Power of Attorney is a legal instrument granting a designated agent the authority to act for a principal in specified financial, medical, or legal matters.

Poa Type

Select the type of authority you wish to grant. Each type has different legal implications.

Table of Contents

What is a Power of Attorney?

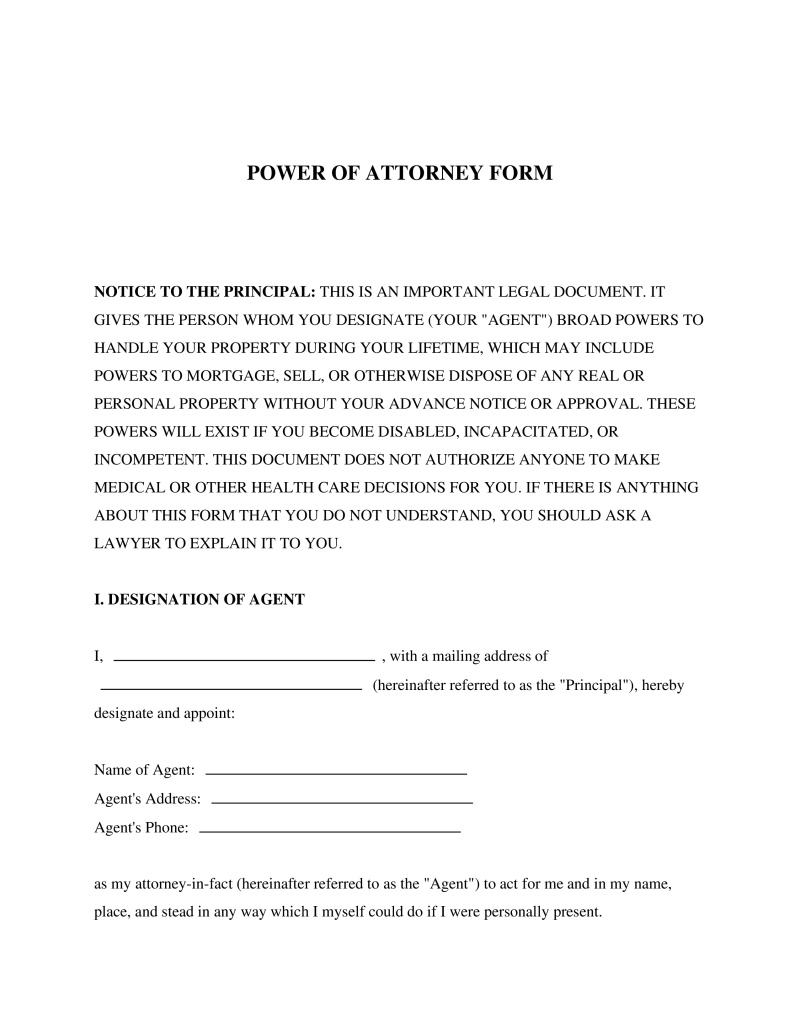

A power of attorney constitutes a legal authorization that allows a designated individual to act on behalf of another person in private affairs, business, or other legal matters. The individual granting this authority is known legally as the principal, grantor, or donor, while the person authorized to act is referred to as the agent or attorney-in-fact. This legal instrument does not require the agent to be a licensed lawyer but establishes a fiduciary relationship obligating the agent to act solely in the principal's best interests. Individuals utilize this document to ensure proper management of their finances, property, or healthcare decisions during periods of absence or incapacitation.

Types of Power of Attorney

The scope of authority granted by a poa varies significantly based on the specific language used in the document. Principals select different variations to suit specific needs, ranging from broad financial management to single-transaction authority.

- General Power of Attorney - Grants the agent comprehensive authority to handle all affairs of the principal, including financial transactions, property management, and legal claims, typically ending if the principal becomes incapacitated.

- Durable Power of Attorney - Contains specific language stating the document remains effective even if the principal becomes mentally incompetent or incapacitated, ensuring continuity of management without court intervention.

- Limited Power of Attorney - Restricts the agent's authority to specific actions or a set time period, such as signing closing documents for a real estate transaction or managing a single bank account.

- Medical Power of Attorney - Authorizes the agent to make healthcare decisions on behalf of the principal, including treatment options and end-of-life care, effective only when the principal cannot communicate their own wishes.

- Springing Power of Attorney - Remains inactive until a specific event or condition occurs, usually the determination of the principal's incapacity by one or more physicians.

The Concept of Durability and Incapacity

Traditional common law dictates that an agency relationship terminates the moment the principal loses the mental capacity to direct the agent. This limitation often defeats the purpose of advance planning. The durable power of attorney solves this issue by including specific statutory language indicating the principal's intent for the authority to survive subsequent disability or incapacity. All fifty states recognize the validity of durable instruments. A durable document allows the agent to continue paying bills, managing investments, and making critical decisions without the need for a court-appointed guardianship. Without a durable clause, the authority ceases exactly when the principal needs assistance the most.

Fiduciary Duties and Agent Responsibilities

The relationship between the principal and the agent is built on trust. The law imposes strict fiduciary duties on the attorney-in-fact to prevent abuse and ensure the principal's assets are protected. An agent must maintain accurate records of all transactions made on the principal's behalf. Mingling the principal's funds with the agent's personal funds is generally prohibited unless specific joint accounts existed previously. The agent must act in good faith, with care, competence, and diligence. Self-dealing, where the agent benefits personally from transactions involving the principal's assets, constitutes a breach of fiduciary duty unless the power of attorney document explicitly permits such actions. Courts hold agents liable for damages resulting from intentional misconduct or gross negligence.

How to Execute a Power of Attorney

Creating a valid agency relationship involves several distinct steps to ensure the document holds up under legal scrutiny. The process generally follows this progression:

- Step 1: Determine the Scope - The principal must decide whether the agent requires broad authority to manage all affairs or limited authority for specific tasks.

- Step 2: Select the Agent - The principal identifies a trustworthy individual, often a spouse, adult child, or close friend, willing to accept the significant responsibility of acting as attorney-in-fact.

- Step 3: Draft the Document - The document is prepared using state-specific forms that include required statutory language, particularly regarding durability and specific powers.

- Step 4: Execute Formalities - The principal signs the document in the presence of a notary public and, in many jurisdictions, witness requirements must be met to satisfy state statutes.

- Step 5: Distribution - The principal provides copies of the executed document to the agent and relevant third parties such as banks, investment firms, and healthcare providers.

Medical Power of Attorney and Healthcare Directives

A medical power of attorney, often called a healthcare proxy, functions differently from financial instruments. This document activates specifically when a physician determines the principal lacks the capacity to make informed medical decisions. The scope of a healthcare agent's authority encompasses consenting to or refusing medical procedures, choosing healthcare providers, and accessing medical records. This document often works in tandem with a living will. While a living will outlines the principal's preferences regarding life support and terminal conditions, the medical poa designates the person empowered to interpret those wishes and make decisions for unanticipated scenarios. Federal privacy regulations affect how these documents function.

Legal Framework and Statutory Requirements

The governance of power of attorney documents falls primarily under state law, though uniform acts attempt to standardize regulations across jurisdictions. The Uniform Power of Attorney Act (UPOAA) has been enacted by numerous states to provide consistency regarding the creation and interpretation of these documents. Key legal considerations include:

- Uniform Power of Attorney Act (UPOAA) - This model legislation provides default rules for the creation and durability of the power of attorney, aiming to prevent financial abuse while ensuring acceptance by third parties.

- Health Insurance Portability and Accountability Act (HIPAA) - Federal law restricts access to personal health information; a valid medical poa must include a HIPAA release clause to allow the agent access to the principal's medical records.

- Capacity Requirements - State statutes universally require the principal to possess contractual capacity at the moment of execution, meaning they must understand the nature and consequences of granting authority.

- Notary and Witness Statutes - Most states, such as Florida and New York, impose strict execution formalities requiring notarization and often two disinterested witnesses for the document to be valid and recordable in land records.

Revocation and Termination

A principal retains the right to revoke a power of attorney at any time, provided they maintain the mental capacity to do so. Revocation typically requires a written document stating the intent to terminate the agent's authority. This revocation must be communicated to the agent and any third parties who relied on the original power of attorney. Authority also terminates automatically upon the death of the principal. At that point, the agent's powers cease immediately, and the executor of the estate assumes control over the decedent's assets. Divorce often automatically revokes a designation of a spouse as an agent in many jurisdictions, though state laws vary on this specific point.

Common Misconceptions

Many individuals mistakenly believe a power of attorney grants the agent ownership over the principal's assets. The document grants management authority, not transfer of title. The principal continues to hold legal title to all property and assets. Another misconception involves the principal's ability to act. Granting a power of attorney does not strip the principal of the ability to make their own decisions. As long as the principal remains capable, they can continue to manage their own affairs and even override decisions made by the agent. The agent serves as an extension of the principal rather than a replacement, until incapacity prevents the principal from acting.

FAQs

Do you have a question about a Power of Attorney?

Example questions:

Not the form you're looking for?

Try our legal document generator to create a custom document

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!